Investing News Network

- Forge Resources Intersects 3.4 g/t Gold over 44.75 Metres, and 800 Metre Step-Out Discovers 1.04 g/t Gold over 55.52 Metres at Alotta, Yukon (2025-12-16)

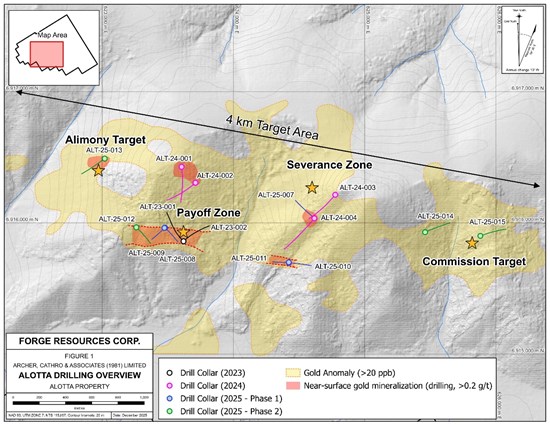

Forge Resources Corp. (CSE: FRG) (OTCQB: FRGGF) (FSE: 5YZ) ("FRG" or the "Company"), is pleased to announce full gold assay results from drill hole ALT-25-012 at the Payoff Zone intersecting 3.4 g/t gold over 44.75 metres from 256.23 metres and discovery results from hole ALT-25-013 at the Alimony Zone grading at 1.04 g/t gold over 55.52 metres from 91.99 metres, at its Alotta Project in Yukon (Figure 1).

Highlights:

- Final results from drill hole ALT-25-012 at Payoff Zone include:

- 76.93 m grading 2.03 g/t Au from 223 metres, including 44.75 m grading 3.4 g/t Au, and 8.16 m grading 17.7 g/t Au and including 1.25 m grading 105 g/t Au. All intervals are drilled core lengths.

- This hole intersected significant amounts of visible gold from narrow quartz veins, in addition to widespread mineralization (See News Release dated November 20, 2025).

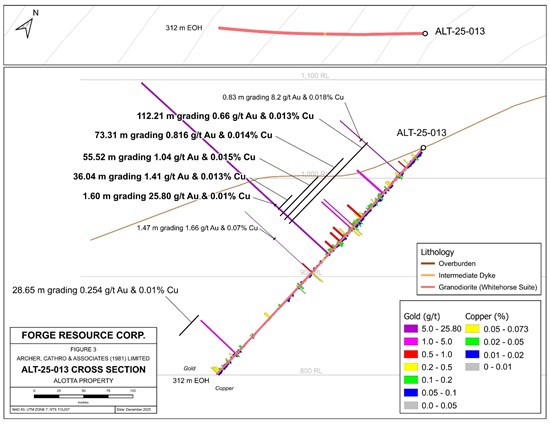

- The Company is pleased to report results from drill hole ALT-25-013, the first and only hole drilled at the Alimony Zone.

- Widespread near-surface gold mineralization was discovered, including 112.21 m grading 0.66 g/t Au near surface from 35.29 metres, including 55.52 m grading 1.04 g/t Au and including 1.6 m grading 25.8 g/t Au. All intervals are drilled core lengths.

- The Alimony Zone lies approximately 800 m west of the Payoff Zone (575 m northwest of drill hole ALT-25-012, above). No drilling has been completed between these two zones.

- This drill hole represents a new drilling discovery at the Alotta Project.

PJ Murphy, CEO of Forge Resources, states: "We are continually impressed by results from the Payoff Zone, which is successfully developing in size and grade with every drill hole. Additionally, we are thrilled to announce the discovery drill results from the Alimony Zone that demonstrates the large-scale fertility of the mineralizing system at Alotta. We are eagerly awaiting the remaining 2025 drill results, from the Commission Zone, which will provide critical data for helping guide future exploration. We are looking forward to the 2026 field season to continue exploring the potential on the property and further advancing our exciting pipeline of targets on the property."

Figure 1. Overview Map of Diamond Drill Holes.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8680/278191_00f0013144f59af0_001full.jpgDiamond Drilling:

A total of 1262.75 m of drilling in 4 drill holes were completed by the Company during the Phase 2 drill program in 2025. Drill hole location data for results reported in this news release are listed in Table 1.

Table 1: Diamond Drill Hole Data

Hole ID Easting (m) Northing (m) Elevation (m) Azimuth Dip Length (m) ALT-25-012 623260 6915966 1078 135 -60 339.75 ALT-25-013 623019 6916490 1031 235 -50 312 Assay highlights of diamond drill holes pertaining to this News Release are found in Table 2 and 3.

Table 2: Payoff Zone Highlight Assay Results

Payoff Zone ALT-25-012 This News Release From

(m)To

(m)Interval

(m)*Au

(g/t)Ag

(g/t)Cu

(%)54.45 65.31 10.86 0.35 0.54 0.02 176.00 185.00 9.00 0.41 0.25 0.01 223.00 301.00 76.93 2.03 1.43 0.02 including 256.23 301.00 44.75 3.40 2.22 0.024 including 284.93 293.10 8.16 17.71 9.31 0.07 including 286.00 289.15 3.15 45.01 17.31 0.13 including 286.00 287.15 1.15 8.85 24.50 0.08 including 287.15 288.40 1.25 105 20.80 0.24 327.94 339.00 11.06 0.34 0.59 0.02 *All intervals are drilled core lengths. Additional drilling is required to establish true widths.

Table 3: Alimony Zone Highlight Assay Results

Alimony Zone ALT-25-013 This News Release From

(m)To

(m)Interval

(m)*Au

(g/t)Ag

(g/t)Cu

(%)35.29 147.52 112.21 0.66 0.61 0.01 including 74.20 147.52 73.31 0.82 0.56 0.01 including 91.99 147.52 55.52 1.04 0.6 0.01 including 109.56 145.60 36.04 1.41 0.55 0.01 including 144 145.6 1.6 25.8 3.14 0.01 282.49 311.14 28.65 0.254 0.84 0.01 *All intervals are drilled core lengths. Additional drilling is required to establish true widths.

Payoff Zone

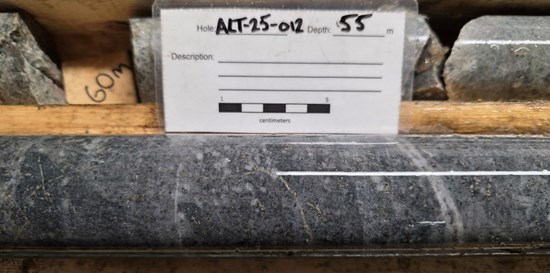

Hole ALT-25-012 drilled through granodiorite and porphyritic rocks and intersected widespread, near-surface alteration, veining, and sulphide mineralization. Alteration includes pervasive secondary biotite that is overprinted by intense silicification, and widespread chlorite and sericite alteration, which are more intense around areas of concentrated veining (Photo 1). Quartz vein-hosted pyrite, molybdenite, chalcopyrite, and pyrrhotite were commonly observed in quartz veins, with the strongest concentrations of veining and mineralization found in the top and bottom 100 metres of the drill hole (Photo 2).

Photo 1. Quartz-pyrite veins with strong chlorite-sericite alteration halos (Alt-25-012, 186 m depth).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8680/278191_forgeimg2.jpgPhoto 2. Quartz vein with centreline of pyrite (right) in porphyritic rocks hosting disseminated pyrite and pyrrhotite (ALT-25-012, 55 m depth)

To view an enhanced version of this graphic, please visit:

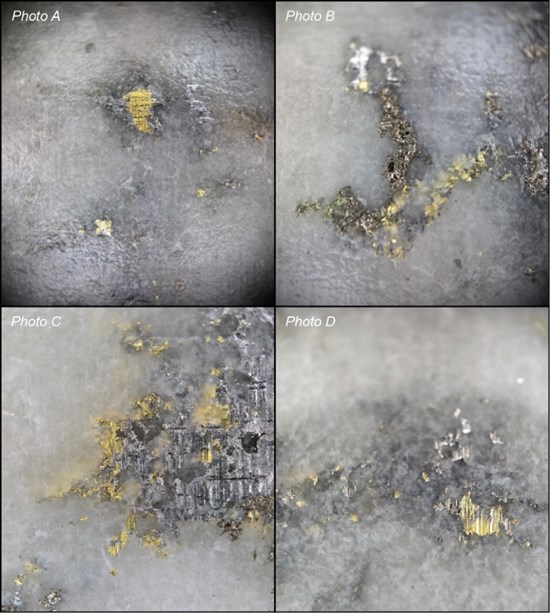

https://images.newsfilecorp.com/files/8680/278191_00f0013144f59af0_003full.jpgAt 287.32 m down hole, below the most intense widespread alteration and mineralization, drilling intersected a low angle (10-30° to core axis) irregular quartz vein, approximately 10 cm wide, hosting visible gold and bismuthinite, along with disseminated to semi-massive pyrrhotite, pyrite, chalcopyrite, arsenopyrite, molybdenite, and sphalerite (Photos 3 and 4). Core sampling of the quartz vein and surround rock returned 1.25 m grading 105 g/t Au. Immediately preceding this sample, a second cm-scale quartz vein hosting visible gold in altered and veined granodiorite returned 1.15 m grading 8.85 g/t Au. In the footwall of the coarse gold-bearing veins, narrow sulphide stringers developed within granodiorite returned 0.47 g/t Au over a core length of 0.75 m.

Photo 3. ~10 cm wide irregular quartz vein cutting granodiorite hosting coarse native gold, bismuthinite, pyrrhotite, pyrite, chalcopyrite, arsenopyrite, molybdenite and sphalerite (ALT-25-012).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8680/278191_00f0013144f59af0_004full.jpgPhoto 4. Photos of coarse visible gold and bismuthinite from a ~10 cm wide vein in drill hole ALT-25-012 (Photo 3 - 287.32 - 288.24 m).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8680/278191_00f0013144f59af0_005full.jpgAlimony Zone

Hole ALT-25-013, collared 800 m northwest of the Payoff Zone and 575 m northwest of drill hole ALT-25-012, was the first hole drilled into the Alimony Zone, a target defined by a tightly constrained 400 by 600 metre molybdenum-gold soil anomaly.

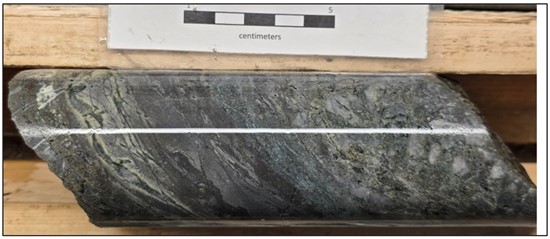

The hole drilled entirely through granodiorite, and intersected widespread, discrete, quartz and carbonate veins with associated sulphide mineralization throughout the top of the hole, and narrow polymetallic quartz veins. Overall, alteration and veining in this hole is less abundant than observed at the Payoff Zone; however, broad intervals of gold mineralization were intersected in the upper 150 m of the drill hole associated with discrete quartz veining, in addition to higher-grade polymetallic quartz veins (Photo 5 and 6).

Photo 5. Banded quartz vein with disseminated and banded sulphides (Alt-25-013, 36 m depth - 8.2 g/t Au over 0.83 m, from 35.29 m depth).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8680/278191_forgeimg6jpgPhoto 6. Banded polymetallic pyrite-pyrrhotite-chalcopyrite vein (Alt-25-013, 170 m depth - 4.59 g/t Au over 0.37 m, from 170.42 m depth).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8680/278191_forgepct6.jpgFigure 2. Cross Section of drill hole ALT-25-013.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8680/278191_00f0013144f59af0_008full.jpgQuality Assurance/Quality Control

Analytical work was completed by ALS Canada Ltd., with sample delivery in Whitehorse, Yukon, sample preparation in Langley, British Columbia, and geochemical analysis in North Vancouver, British Columbia.

Rigorous procedures are in place regarding sample collection and data entry. Certified assay standards, coarse reject duplicates, field duplicates and blanks were routinely inserted into the sample stream to ensure integrity of the assay process. All of the results reported have passed the QA/QC screening. Core was sampled using a diamond core saw, with half of each interval sent to the lab for analysis and the other half retained.

Half-core samples were fine-crushed and a 250 g split was pulverized to better than 85% passing 75 microns. Gold was determined for core samples using a 50 g charge by fire assay followed by an atomic absorption spectroscopy finish (Au-AA24). The fine fraction was analyzed for 48 elements using a four acid digestion followed by inductively coupled plasma combined with mass spectroscopy and atomic emission spectroscopy finish (ME-MS61)

Fire assay screen analysis was completed using a 1 kg sample size screened to -106 microns. Oversize material was analyzed in entirety by fire assay with gravimetric finish. A 30 g assay of the undersized material was analyzed in duplicate by fire assay with atomic absorption spectroscopy finish. Results of the oversize and undersize assays were combined to provide the final reported number in this release.

Proximity to Measured and Indicated Resources

The Alotta property consists of 230 mineral claims that covers approximately 4,723 hectares in a similar geological setting to Western Copper and Gold's Casino deposit, that is located 50 km to the north of the Alotta Project. The Casino deposit is one of the largest undeveloped copper-gold porphyry projects in the world.

About Forge Resources Corp.

Forge Resources Corp. is a Canadian-listed junior exploration company focused on exploring and advancing the Alotta project, a prospective porphyry copper-gold-molybdenum project consisting of 230 mineral claims that cover 4,723 hectares, located 50 km south-east of the Casino porphyry deposit in the unglaciated portion of the Dawson Range porphyry/epithermal belt in the Yukon Territory of Canada.

In addition, the Company holds an 80% interest in Aion Mining Corp., a company that is developing the fully permitted La Estrella coal project in Santander, Colombia. The project contains eight known seams of metallurgical and thermal coal.

Qualified Person

Lorne Warner, President and P. Geo, is a qualified person as defined by National Instrument 43-101 and has reviewed and approved the scientific and technical disclosure in this news release.

On behalf of the Board of Directors

"PJ Murphy", CEO Forge Resources Corp.

info@forgeresources.comForward-Looking Statements

Certain of the statements made and information contained herein may contain forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking information includes, but is not limited to, information concerning the Company's intentions with respect to the development of its mineral properties. Forward-looking information is based on the views, opinions, intentions and estimates of management at the date the information is made, and is based on a number of assumptions and subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated or projected in the forward-looking information (including the actions of other parties who have agreed to do certain things and the approval of certain regulatory bodies). Many of these assumptions are based on factors and events that are not within the control of the Company and there is no assurance they will prove to be correct. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by applicable securities laws, or to comment on analyses, expectations or statements made by third parties in respect of the Company, its financial or operating results or its securities. The reader is cautioned not to place undue reliance on forward-looking information. We seek safe harbor.

- Final results from drill hole ALT-25-012 at Payoff Zone include:

- Disrupting the Gold Standard: Eyeing Cyanide-free Alternatives in Resource Extraction (2025-12-16)

In a $2 billion cyanide market that underpins global gold extraction, a seismic shift is underway as environmental concerns and evolving investment standards push the industry towards safer, more sustainable alternatives.

For over a century, cyanide has been the gold standard in mining, driven by its simplicity, low-cost and its ability to extract gold from low-grade ores. However, current environmental concerns are encouraging mining companies to evaluate sustainable alternatives. Although cyanide will likely continue its dominance over the near term, emerging technologies such RZOLV Technologies' (TSXV:RZL) RZOLV formula, are promising to revolutionize the sector, offering both environmental stewardship and lucrative opportunities for forward-thinking investors.

Cyanide in gold mining: A historical perspective

The adoption of cyanide in gold mining dates back to the 1870’s, revolutionizing the industry with its ability to extract gold from low-grade ores. Its effectiveness, coupled with relatively low costs, quickly established cyanide leaching as the preferred method for gold recovery. This process, known as cyanidation, allowed for the profitable exploitation of previously uneconomical deposits, ushering in a new era of gold production.

Despite its efficacy, the use of cyanide has always been accompanied by environmental and safety concerns. Early regulatory efforts sought to mitigate risks associated with its toxicity, but the economic advantages of cyanide-based extraction continued to outweigh these considerations for many decades.

Today, the gold-mining industry faces unprecedented scrutiny. The rise of ESG investment standards has placed significant pressure on mining companies to adopt more sustainable practices. Investors are also increasingly wary of the reputational and financial risks associated with environmentally harmful mining techniques.

In recent years, regulatory bodies worldwide have implemented stricter environmental regulations, directly impacting cyanide-dependent operations. These evolving standards not only pose compliance challenges, but also threaten the long-term viability of traditional extraction methods. Several countries, including Costa Rica, Argentina, Germany, Hungary and the Czech Republic, have taken decisive action to ban or heavily regulate the use of cyanide in gold-mining operations.

This shift reflects a global trend towards more sustainable mining practices and stricter environmental protections. As a result, mining companies now find themselves navigating a complex landscape where environmental stewardship is as crucial as operational efficiency.

Ripe for industry disruption

The gold-mining sector's search for cyanide alternatives is driven by a combination of environmental pressures, regulatory changes and economic incentives. Clean extraction technologies offer numerous benefits:

- Reduced environmental liabilities and associated costs

- Improved social license to operate in sensitive areas

- Enhanced compliance with evolving regulations

- Potential access to new deposits previously considered too environmentally sensitive for traditional mining methods

The transformation of the gold-mining industry is well underway, driven by technological innovation and changing societal expectations. Investors play a crucial role in this transition, with their support accelerating the adoption of cleaner technologies. As ESG considerations become increasingly central to investment decisions, companies embracing sustainable practices are likely to see enhanced access to capital and improved market valuations.

Technology companies that present a viable and more sustainable alternative to cyanide-based mining have the potential to take a bite from the massive multi-billion cyanide industry.

“There's $2 billion worth of cyanide consumed every year with no current alternative. Even a small market share would result in significant revenues,” said Duane Nelson, CEO of RZOLV Technologies, in an interview with Investingnews.com.

He added, “We are developing the only cost-effective alternative to the extensive use of cyanide in gold extraction. With over 90 percent of global gold production relying on cyanide, there’s definitely a business model here that makes a lot of sense,” Nelson added.

RZOLV Technologies: Pioneering clean gold extraction

RZOLV Technologies has achieved a breakthrough that promises to revolutionize gold extraction. Its eco-friendly chemical formula, called RZOLV, is designed for the efficient extraction of precious metals from ores, concentrates and tailings. The cyanide-free solution is inexpensive, safe, stable and scalable, representing a paradigm shift and disrupting the status quo toward responsible and sustainable mining.

RZOLV is a water-based, non-toxic formula, effectively dissolving gold from ores, concentrates and tailings into a stable gold complex. RZOLV integrates seamlessly with existing mining infrastructure and is compatible with most leaching systems. Recent independent testing by SGS, the world's leading inspection, verification, testing and certification firm, confirms that RZOLV delivered 85.69 percent gold recovery, similar to cyanide, which achieved 84.90 percent under the identical conditions. The potential benefits include streamlined permitting processes, reduced contamination risk, improved compliance with regulations, lower insurance, monitoring and remediation costs.

This innovative approach not only addresses the environmental concerns associated with cyanide use but also aligns with the industry's growing focus on sustainability.

Future of sustainable gold mining

Policy changes favoring green mining practices are anticipated to increase over the near term. Governments worldwide are exploring incentives for sustainable resource extraction, potentially creating a regulatory environment that further encourages the adoption of cyanide-free technologies. This shift not only benefits the environment but also opens new opportunities for mining companies to operate in previously restricted areas.

As cyanide-free extraction technologies mature and gain widespread adoption, the industry may witness a fundamental reshaping of the sector. This evolution promises not only to mitigate environmental risks but also to unlock new value for investors, communities and the planet.

Investor takeaway

The shift toward more environmentally friendly gold extraction represents both a challenge and an opportunity for the mining industry. Companies like RZOLV Technologies are leading the charge, demonstrating that profitability and sustainability are not mutually exclusive. As this golden revolution unfolds, it offers a compelling narrative of innovation, responsibility and sustainable growth in one of the world's oldest industries.

For more information, visit the company's website at www.rzolv.com.This INNspired article is sponsored by RZOLV Technologies. This INNspired article provides information which was sourced by the Investing News Network (INN) and approved by RZOLV Technologies to help investors learn more about the company. RZOLV Technologies is a client of INN. The company’s campaign fees pay for INN to create and update this INNspired article.

This INNspired article was written according to INN editorial standards to educate investors.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with RZOLV Technologies and seek advice from a qualified investment advisor.

- Mark These Tax-loss Selling Dates on Your Calendar (2025-12-16)

As the end of 2025 nears, investors may want to consider how they can use tax-loss selling to their benefit.

Buying stocks low and selling them high is ideal, but sometimes investments go sour. In such cases, all hope is not lost — at the end of the year, investors can sell investments that provided losses instead of capital gains.

The money made from selling off losses can then be used to offset capital gains liabilities incurred for the year. This is the principle behind tax-loss selling, also known as tax-loss harvesting.

This valuable strategy offers investors another opportunity to lower their tax bill for 2025. So let’s take a look at how tax-loss selling works, plus the final tax-loss selling dates for investors in Canada, the US and Australia.

In this article

- How does tax-loss selling work?

- What are the important tax-loss selling dates for 2024?

- The flip side of tax-loss selling

- How can investors time tax-loss selling?

How does tax-loss selling work?

Tax-loss selling is the process of selling stocks at a loss to reduce the capital gains earned on an investment. Since capital losses are tax deductible, they can be used to offset capital gains and reduce tax liability on an investor’s tax return.

Tax-loss selling generally involves investments that have seen significant losses, and because of this, these sales generally focus on a relatively small number of securities within the public markets.

In cases where many investors are executing a sell order in tandem, the price of the securities will fall. In addition, the fact that tax-loss selling often occurs in November and December means the most attractive securities for tax-loss selling at that time are investments that could generate strong capital gains early in the next year, as once selling season has ended, shares that have become largely oversold can bounce back.

Some investors may consider selling an asset at a loss, deducting that loss for a tax gain and then purchasing the same stock again in an effort to evade taxes. This is known as a wash sale, and is prohibited by the Internal Revenue Service (IRS); if the IRS deems a transaction to be a wash, the investor would not be allowed any tax benefits.

To avoid this situation, investors must wait 30 days to repurchase shares that were originally sold for a loss. Additionally, shares sold for a loss must have been in the investor’s possession for over 30 days.

As a result, a potentially beneficial strategy would be to buy during the selling season and sell after the tax loss has been established. This approach could be used on either long-term capital gains or short-term capital gains.

What are the important tax-loss selling dates for 2025?

Tax-loss selling comes with many potential benefits, but it nevertheless has some strings attached.

The key thing for investors to remember is that it has deadlines. For investors filing their taxes in Canada, the last day for tax-loss selling in 2025 is December 30. Transactions for stocks purchased or sold after this date will be settled in 2025, so any capital gains or losses will apply to the 2025 tax year.

The timing for the tax-loss selling deadline for Canadians was altered in May 2024, when Canada switched to a T+1 settlement cycle (one business day following the trade date) from a T+2 one.

The system differs for investors who are filing their taxes in the US. Based on information provided by the IRS, the last day for tax-loss selling in the United States this year is December 31.

For Australian investors, the final date for tax-loss selling is June 30, 2026, which is the final day of the 2025/2026 financial year.

Investors should always consult with an expert or review relevant tax documents directly for complete answers. The information contained in this article should not be considered tax advice.

The flip side of tax-loss selling

As tax-loss selling starts, opportunities can open up for those who have spent the year on the sidelines.

In her piece “How Bout Tax Loss Buying?,” Gwen Preston of Resource Maven explains that Canaccord Genuity Group (TSX:CF,OTC Pink:CCORF) has found that from mid-November to mid-December, S&P/TSX Composite Index (INDEXTSI:OSPTX) stocks that are down more than 15 percent year-to-date underperform the index by nearly 4 percent. However, from mid-December to mid-January, those same stocks outperform the index by 3.6 percent.

“That outperformance is on top of gains the TSX reliably generates over that time frame,” Preston explains. “So instead of only seeing tax-loss selling as a time to generate tax credits by dumping dogs, let’s look at the opportunity to profit.”

Watch Gwen Preston of Resource Maven discuss tax-loss selling.

How can investors time tax-loss selling?

Regardless of whether you’re engaging in tax-loss selling or buying, Steve DiGregorio, portfolio manager at Canoe Financial, recommends acting swiftly and aggressively as “liquidity will dry up.”

He sees the second and third week of December as the ideal window, which is well ahead of the “Santa Claus rally” — the period around the last week of December when stocks tend to rise ahead of a healthier market in January.

For now, the year isn’t over yet, so whether you’re tax-loss selling or buying, there’s still time to talk to your accountant or financial advisor to determine which approach is best for you.

This is an updated version of an article first published by the Investing News Network in 2014.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Lauren Kelly, hold no direct investment interest in any company mentioned in this article.

- Canadian Approval Pushes Teck, Anglo Closer to Creating US$53 Billion Miner (2025-12-16)

Canada has approved the merger of Teck Resources (TSX:TECK.A,TECK.B,NYSE:TECK) and Anglo American (LSE:AAL,OTCQX:AAUKF), clearing a major regulatory hurdle for the creation of a new global mining heavyweight worth over US$53 billion.

Teck and Anglo American said they received approval under the Investment Canada Act, allowing the companies to proceed with their planned “merger of equals,” first announced in September.

The transaction will combine the two miners into a new entity, Anglo Teck, which will be headquartered in Vancouver and positioned as a major global supplier of copper and other critical minerals.

Industry Minister Mélanie Joly said she determined the transaction would deliver a net benefit to Canada, adding that the deal represents “an unequivocal endorsement of the federal government’s efforts to build the strongest economy in the G7.”

She further added that Anglo Teck, with its headquarters in Vancouver, “will be a truly Canadian champion on the world stage.”

Both companies emphasized that the approval formalizes a wide-ranging set of binding commitments negotiated with Ottawa, aimed at securing investment, jobs, and governance influence in Canada over the long term.

Under those undertakings, Anglo Teck will spend at least C$4.5 billion in Canada over the first five years following completion, supporting key projects such as the life extension of the Highland Valley Copper mine, upgrades to critical minerals processing at Teck’s Trail operations, and advancement of the Galore Creek and Schaft Creek copper projects in Northwestern BC.

Furthermore, Anglo Teck’s global headquarters will be based in Canada, with a significant majority of senior management, including the chief executive, deputy chief executive, and chief financial officer, residing primarily in the country. A substantial proportion of the board will also be Canadian.

The combined company will retain a listing on the Toronto Stock Exchange, alongside a primary listing in London and secondary listings in Johannesburg and New York.

Beyond governance, the commitments include maintaining employment levels across Teck’s Canadian operations, expanding youth employment and training opportunities, and ensuring Canadian and Indigenous suppliers have fair access to contracts across Anglo Teck’s global operations.

The company has also committed to honouring all existing agreements with Indigenous governments, communities, and labour unions while maintaining and advancing environmental and social standards in Canada.

Anglo Teck has further pledged to invest in exploration and innovation, which includes at least C$300 million in Canadian critical mineral exploration and the establishment of a Global Institute for Critical Minerals Research and Innovation involving institutions in Canada, South Africa, and the UK.

Over a 15-year period, total spending in Canada is expected to reach at least C$10 billion.

Jonathan Price, Teck’s president and chief executive, said in a recent press release that the merger will create “a business of significant scale and capability that will deliver billions in investment and drive new economic activity and job creation here in Canada and beyond.”

The deal has also drawn strong political support in BC, where several of the company’s key assets are located.

In a social media post, Premier David Eby said the merger was “great news,” calling Anglo Teck “the largest company in our province’s history.” He said the combined company would “help unlock prosperity in the Northwest and deliver good jobs and benefits across the province.”

The merger was approved by shareholders of both companies at meetings held on December 9.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

- CMOC to Acquire Equinox Gold’s Brazilian Assets for US$1.015 Billion (2025-12-16)

China’s CMOC Group (OTC Pink:CMCLF) has agreed to buy a portfolio of gold assets in Brazil from Canada’s Equinox Gold (TSX:EQX,NYSEAMERICAN:EQX) for US$1.015 billion.

CMOC said Monday (December 15) that it will acquire 100 percent of Equinox Gold’s Brazilian operations, comprising the Aurizona mine in Maranhão, the RDM mine in Minas Gerais and the Bahia complex, which includes the Fazenda and Santa Luz mines.

The acquired assets collectively host total gold resources of 5.013 million ounces and reserves of 3.873 million ounces, according to CMOC. Gold production from the Brazilian operations totaled 247,300 ounces in 2024, in line with Equinox’s guidance of 250,000 to 270,000 ounces of output this year.

The consideration includes a US$900 million upfront cash payment at closing and a contingent payment of up to US$115 million tied to production volumes during the first year after closing.

“The transaction is an important step that showcases our conviction in gold and delivers on our strategy of pillaring the portfolio on copper and gold,” said Liu Jianfeng, chairman and chief investment officer of CMOC, in a press release.

CMOC said the deal will add around eight tons of annual gold production to its portfolio. The company expects its gold output to potentially exceed 20 tons a year once its Odin gold mine in Ecuador enters operation, positioning the group for further long-term growth in the metal.

For Equinox Gold, the sale also marks a change in operational strategy. The Vancouver-based said divesting its Brazilian assets will simplify its portfolio and sharpen its focus on North America.

Chief executive Darren Hall described the move as a turning point for the company, calling the transaction a “pivotal step” toward becoming a pure North American-focused gold producer.

Following the sale, Equinox’s core assets will include the Valentine and Greenstone mines in Canada, both of which entered commercial production within the past 13 months, and the long-running Mesquite mine in California.

Greenstone is expected to produce between 220,000 and 260,000 ounces of gold this year, while Valentine is forecast to deliver 175,000 to 200,000 ounces annually once fully ramped up. The Mesquite mine is also projected to contribute around 95,000 ounces in 2025.

As production at its Canadian operations ramps up to full capacity, Equinox said it anticipates annual gold output in the range of 700,000 to 800,000 ounces next year and plans to release detailed production and cost guidance in early 2026.

The transaction is expected to close in the first quarter of 2026, subject to regulatory approvals and conditions.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.