Investing News Network

- Top 5 Canadian Mining Stocks This Week: Adex Mining Extends Gains with 100 Percent Jump (2026-03-06)

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian news impacting the resource sector.

The Government of New Brunswick announced a new comprehensive mineral strategy on Tuesday (March 3), at the 2026 Prospectors and Developers Association of Canada conference in Toronto.

The plan calls for a streamlined permitting process that will ensure clear communication and transparent timelines. Additionally, it promises a collaborative partnership with First Nations, science-based decision-making and a community-based approach to jobs, procurement and infrastructure.

Oil prices jumped significantly this week following the start of the US-led war against Iran. West Texas Intermediate has surged more than 25 percent since March first, climbing to over US$90 per barrel in trading on Friday, the first time since October 2022.

The most significant gains came on Friday, after Iran effectively stopped traffic through the Strait of Hormuz. More than 20 percent of the world’s liquefied natural gas and 25 percent of oil shipments travel through the strait.

The price rise has had a downstream effect on gas prices in Canada and the US, increasing by up to C$0.10 per liter and US$0.27 per gallon, respectively.

Over the past week, US producers have activated four additional rigs, bringing the total rig count to 411, although that total is down by 75 from the same period last year. Most companies are unlikely to rush to restart operations shuttered due to low oil prices until there is a more sustainable rise in oil prices.

Meanwhile, the war caused turmoil in bond markets as concerns over inflation and rising central bank interest rates seeped into the market. US two-year bonds rose by 18 basis points, while Britain’s rose by 43 basis points.

For more on what’s moving markets this week, check out our top market news round-up.

Markets and commodities react

Canadian equity markets were largely down this week.

The S&P/TSX Composite Index (INDEXTSI:OSPTX) fell 3.87 percent over the week to close Friday (March 6) at 33,083.72, while the S&P/TSX Venture Composite Index (INDEXTSI:JX) slipped 4.54 percent to 1,057.04.

However, the CSE Composite Index (CSE:CSECOMP) gained 1.27 percent to 178.51.

The gold price fell 3.31 percent to close at US$5,170.63 per ounce on Friday at 4:00 p.m. EST. The silver price fared worse, closing the week down 6.4 percent at US$84.30 on Friday.

In base metals, the Comex copper price recorded a 2.01 percent decrease this week to US$5.85 per pound.

The S&P Goldman Sachs Commodities Index (INDEXSP:SPGSCI) was up 16.14 percent to end Friday at 700.62.

Top Canadian mining stocks this week

How did mining stocks perform against this backdrop? Take a look at this week’s five best-performing Canadian mining stocks below.

Stocks data for this article was retrieved at 4:00 p.m. EST on Friday using TradingView's stock screener. Only companies trading on the TSX, TSXV and CSE with market caps greater than C$10 million are included. Mineral companies within the non-energy minerals, energy minerals, process industry and producer manufacturing sectors were considered.

1. Adex Mining (TSXV:ADE)

Weekly gain: 100 percent

Market cap: C$128.67 million

Share price: C$0.19Adex Mining is an exploration company that holds a 100 percent stake in the Mount Pleasant project in Southwest New Brunswick, Canada. The property contains two main deposits: the Fire Tower zone, which hosts tungsten and molybdenum mineralization, and the North zone, which hosts tin, zinc and indium.

The asset consists of 102 mineral claims covering 1,600 hectares, as well as equipment and facilities from historic mining operations conducted by BHP (ASX:BHP,NYSE:BHP,LSE:BHP) between 1983 and 1985.

According to its most recent investor presentation released on June 11, the property hosts the world’s largest indium reserve and North America’s largest tin deposit. Indicated resources for the North zone demonstrate contained metal values of 47 million kilograms of tin, and 789,000 kilograms of indium from 12.4 million metric tons with average grades of 0.38 percent tin and 64 parts per million indium.

Adex Mining has not released news since it published its interim management discussion and analysis on November 18.

In a mid-February interview, New Brunswick Natural Resources Minister John Herron revealed that a deal “is due imminently with a well-known company in the Canadian mining community” for Adex’s Mount Pleasant project.

While the company did not release news this week, the project may benefit from the freshly announced New Brunswick Comprehensive Mineral Strategy. The report highlights Mount Pleasant’s indium, tin and tungsten mineralization.

2. Southern Energy (TSXV:SOU)

Weekly gain: 91.67 percent

Market cap: C$29.3 million

Share price: C$0.115Southern Energy is an oil and gas company with assets located in Mississippi, US. The majority of its production is natural gas.

Its operations are centered around the state’s Interior Salt Basin, in the northeastern Gulf Coast Region. Southern has an interest in producing wells spread across several assets, including Gwinville, Mechanicsburg and Mount Olive East.

According to a February 2026 corporate presentation, current production from the company’s wells is about 11 million cubic feet of natural gas equivalent per day, with 27.9 million barrels of oil equivalent in reserves.

The company’s most recent news came on February 12, when Southern closed a non-brokered private placement that generated proceeds of US$23.5 million. The company said the funds will be used to repay the balance of a US$12.9 million senior credit facility, with the rest being directed to development capital, including the completion of two wells in Gwinville.

The share price gains also come amid volatility in the energy market.

3. Africa Energy (TSXV:AFE)

Weekly gain: 86.67 percent

Market cap: C$165.31 million

Share price: C$0.42Africa Energy is a South Africa focused oil and gas exploration and development company.

Its flagship asset is Block 11B/12B located approximately 175 kilometers off the south coast of South Africa. The block covers an area of 18,734 square kilometers and depths between 200 meters and 1,800 meters.

It holds a 4.9 percent interest in the asset through its investment in Main Street 1549, a 49/51 joint venture with Arostyle Investments. The three other partners in the asset announced plans to withdraw from the Block 11B/12B joint venture in July 2024, and announced a definitive agreement for the new ownership structure of the Block 11B/12B asset in May 2025.

The restructuring would result in Africa Energy owning a direct 75 percent stake in the block, with Arostyle holding the remainder. This is contingent on the asset being granted the production rights, which itself requires approval of its environmental and social impact assessment. The report must be submitted by May 2026.

Shares of Africa Energy posted gains this week amid energy market volatility.

The company has not released any news since January 26, when it announced the resignation of Dr. Phindile Masangane as Director and Head of Strategy and Business Development. She will still assist Africa Energy as a consultant.

4. Gabriel Resources (TSXV:GBU)

Weekly gain: 60 percent

Market cap: C$41.58 million

Share price: C$0.16Gabriel Resources is a precious metals explorer and developer focused on advancing its Rosia Montana gold project. Based in Transylvania, Romania, Rosia Montana is in a region that has seen significant historic mining. Covering 2,388 hectares, the site is host to a mid-to-shallow epithermal system containing deposits of gold and silver.

The most recent resource estimate from a 2012 technical report shows proven and probable quantities of 10.1 million ounces of gold and 47.6 million ounces of silver. Gabriel has invested more than US$760 million into Rosia Montana, but has undertaken little development at the site since the early 2010s, as Romania blocked further development.

In 2015, the company entered into arbitration through the World Bank’s International Center for Settlement of Investment Disputes (ICSID) over permitting at the site and suggested that Romania was in violation of bilateral investment treaties. In March 2024, Gabriel issued a press release with an update saying that its case against Romania had been dismissed by the ICSID, which also awarded Romania US$10 million in legal fees and expenses. Gabriel said it would review the decision with its legal team and evaluate its options.

In March 2025, Gabriel announced that the committee had ruled that a stay of enforcement of the Award would continue if Gabriel guaranteed the proven solvency of the US$10 million.

The committee was scheduled to hold hearings on January 22 and 23 of this year, but on January 19, Gabriel reported that the hearings would be postponed to a later date. A new date for the hearing has not been announced.

The company did not release news in the past week.

5. Rio Silver (TSXV:RYO)

Weekly gain: 48.05 percent

Market cap: C$41.58 million

Share price: C$1.14Rio Silver is an exploration company advancing its Maria Norte project in Peru. The property changed hands several times in the 18 years prior to Rio Silver's acquisition in March 2025, but saw little exploration during that time.

However, in a February 5 release, the company noted that historic mining occurred as the site hosts a reclaimed waste dump. In that announcement, the firm said it plans to advance surface mapping and sampling in the third quarter of 2026.

Throughout January, Rio Silver made several announcements regarding its exploration and development timeline. On January 6, the company reported results from technical work at the site, confirming the presence of silver mineralization with grades up to 991 g/t in a 0.7 meter channel sample.

To end the month, the company said it was launching a metallurgical program at the site to assist in determining the project’s potential value.

The most recent news came last week in a pair of releases.

The first on February 25, the company announced a new private placement to raise proceeds of up to C$3 million. Funds will be used to advance work at the Maria Norte project. The placement is being led by Sprott (TSX:SII,NYSE:SII) Founder Eric Sprott.

The second release came on February 26 when Rio reported it secured permission from the local community to begin site activities at Maria Norte. The company said it will continue working with the community to develop a formal definitive agreement for long-term exploration and mining activities.

FAQs for Canadian mining stocks

What is the difference between the TSX and TSXV?

The TSX, or Toronto Stock Exchange, is used by senior companies with larger market caps, and the TSXV, or TSX Venture Exchange, is used by smaller-cap companies. Companies listed on the TSXV can graduate to the senior exchange.

How many mining companies are listed on the TSX and TSXV?

As of December 2025, 898 mining companies and 71 oil and gas companies are listed on the TSXV, combining for more than 60 percent of the 1,531 total companies listed on the exchange.

As for the TSX, it is home to 175 mining companies and 51 oil and gas companies. The exchange has 2,089 companies listed on it in total.

Together, the TSX and TSXV host around 40 percent of the world’s public mining companies.

How much does it cost to list on the TSXV?

There are a variety of different fees that companies must pay to list on the TSXV, and according to the exchange, they can vary based on the transaction’s nature and complexity. The listing fee alone will most likely cost between C$10,000 to C$70,000. Accounting and auditing fees could rack up between C$25,000 and C$100,000, while legal fees are expected to be over C$75,000 and an underwriters’ commission may hit up to 12 percent.

The exchange lists a handful of other fees and expenses companies can expect, including but not limited to security commission and transfer agency fees, investor relations costs and director and officer liability insurance.

These are all just for the initial listing, of course. There are ongoing expenses once companies are trading, such as sustaining fees and additional listing fees, plus the costs associated with filing regular reports.

How do you trade on the TSXV?

Investors can trade on the TSXV the way they would trade stocks on any exchange. This means they can use a stock broker or an individual investment account to buy and sell shares of TSXV-listed companies during the exchange's trading hours.

Article by Dean Belder; FAQs by Lauren Kelly.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Lauren Kelly, hold no direct investment interest in any company mentioned in this article.

- Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet (2026-03-06)

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet.

"It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in governments and particularly lack of trust in fiat currencies."

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

- Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now (2026-03-06)

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats.

In his view, gold and silver equities may still only be in the second inning.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

- Peter Krauth: Silver Cycle Still Early, Big Money Ready to Buy (2026-03-06)

Peter Krauth, editor of Silver Stock Investor and Silver Advisor, shares his thoughts on silver price activity and where the white metal is in the cycle.

He believes the awareness phase is just beginning, with mania still relatively far in the future.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

- Tech Weekly: Stocks Sink as Iran War Continues, Stoking Inflationary Fears (2026-03-06)

Welcome to the Investing News Network's weekly brief on tech news and tech stocks driving the market.

We also break down next week's catalysts to watch to help you prepare for the week ahead.

In this article:

- This week's tech sector performance

- 3 tech stocks moving markets this week

- Top tech news of the week

- Tech ETF performance

- Tech catalysts to watch next week

This week's tech sector performance

The tech-heavy Nasdaq Composite (INDEXNASDAQ:.IXIC) navigated a volatile week.

Early week caution gave way to a rebound by Monday’s close (March 2), with the Nasdaq eking out a small gain led by defense and tech stocks. On Tuesday (March 3), the Trump administration’s plans to secure the Strait of Hormuz shipping lanes helped pare losses, with major indexes closing down but less severely.

US services PMI on Wednesday (March 4) showed the fastest expansion since mid-2022, supporting gains; however, the Nasdaq rose only slightly, with gains capped by lingering oil price worries.

Markets plunged on Thursday (March 5) after an Iranian missile strike on an oil tanker in the Persian Gulf intensified concerns of conflict longevity and supply constraints. The price of oil surged to its biggest weekly gain since 2022, with analysts forecasting further increases if the Strait of Hormuz stays disrupted beyond 3 - 4 weeks.

Also on Thursday, reports surfaced that the administration was considering new rules requiring US approval for AI chips shipped abroad, which hit Nasdaq heavyweights NVIDIA (NASDAQ:NVDA) and Advanced Micro Devices (NASDAQ:AMD). This revelation followed earlier reports that officials were considering limiting purchases of Nvidia’s H200 chips and AMD's MI325 chips, which have similar capabilities, to Chinese companies, capping them at 75,000 chips per firm.

Friday’s (March 6) jobs report for February boosted rate-cut odds but fueled recession fears. The report showed nonfarm payrolls dropped by 92,000, a stark contrast to the forecasted 50,000 to 60,000 added jobs. Additionally, unemployment increased to 4.4 percent, signaling that the labor market is cooling faster than expected.

These macroeconomic pressures and geopolitical uncertainty exerted a palpable weight on financial markets, heavily impacting volatility-sensitive tech stocks.

3 tech stocks moving markets this week

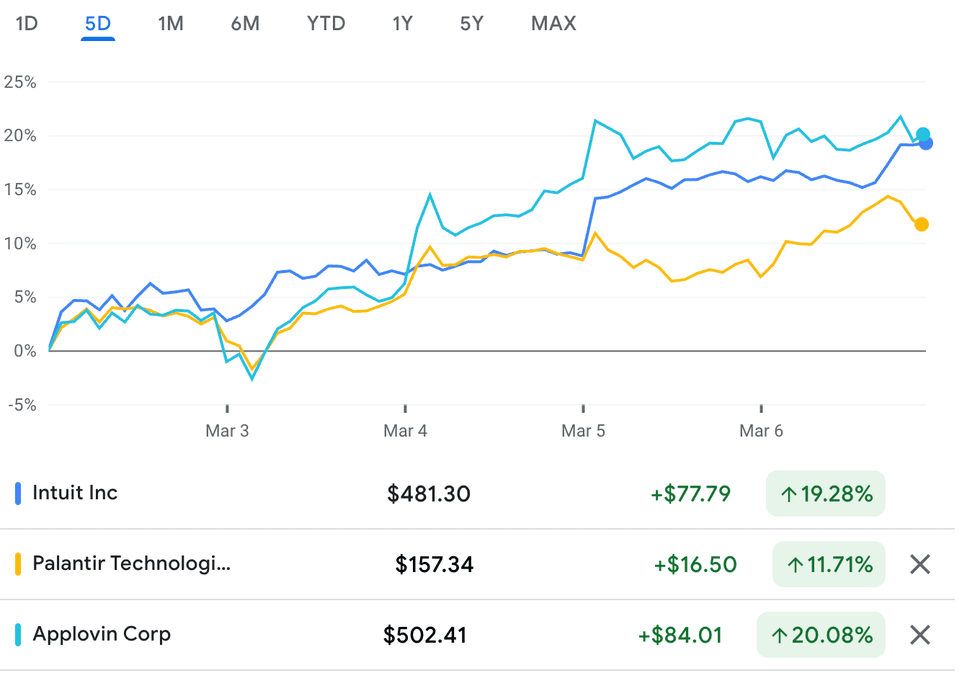

1. Intuit (NASDAQ:INTU)

Intuit had a strong week, finishing up 25.08 percent as investors rotated into defensive fintech and software amid weakness in the capital-intensive and cyclical semiconductor sector.

Zacks Investment Research explained Intuit’s stock rise as a gain driven by analyst upgrades and price target hikes. Piper Sandler raised its price target on Intuit to US$780 and maintained an Overweight rating. Susquehanna also raised its target to US$850 and kept a Positive rating. Meanwhile, TD Cowen cut its target to US$633 but reiterated Buy.

Analysts cited Intuit’s strong AI-driven results from last week’s Q2 earnings and highlighted growth in the company’s GBS Online Ecosystem, Desktop Ecosystem and Credit Karma.

2. Palantir Technologies (NASDAQ:PLTR)

Palantir gained alongside other defense stocks as Mideast tensions boosted demand for defense AI. Shares rose more than five percent on Monday, while analysts at Wedbush named it a top pick on Thursday with a US$75 price target. Palantir gained 17.22 percent for the week.

2. AppLovin (NASDAQ:APP)

AppLovin ranked third for this week’s gainers, closing 16.29 percent higher on Arete’s upgrade to neutral from sell, with an adjusted price target down to US$340 From US$458. Speculation about AppLovin potentially launching a competing app to rival TikTok may have further contributed to the gains.

Top tech news of the week

- Broadcom (NASDAQ:AVGO) jumped on Thursday morning after reporting quarterly financial figures that were slightly above estimates, as well as strong current-quarter guidance after hours on Wednesday. The company’s revenue reached US$14.9 billion, up 34 percent YoY, with AI revenue reaching US$4.1 billion. EPS came to US$1.72, beating estimates of US$1.65. The company’s Q2 guidance forecasted revenue between US$15.25 billion and US$15.65 billion.

- Marvell Technology (NASDAQ:MRVL) rose on post-earnings momentum from its FY26 results reported Thursday. The company reported US$8.195 billion in revenue, a 42 percent gain YoY. EPS came in at US$2.84, 81 percent higher, while Q4 AI networking revenue hit US$2.2 billion amid data center strength. FY27 guidance was strong, with 30 percent overall growth and US$2.2 billion in forecasted revenue for Q1, beating estimates.

- Apple (NASDAQ:AAPL) made a string of announcements this week during its “March Madness” product reveal, unveiling low-priced devices including a US$599 iPhone 17e, equipped with the A19 chip, as well as a new US$599 MacBook Neo powered by the A18 Pro chip. Premium options were also revealed, such as the new MacBook Pro with M5 Pro and M5 Max chipsets and M5-updated MacBook Air and Pro models.

- In the prediction market space, Kalshi announced Monday it has struck a deal with Associated Press to license election data, beginning with the midterms. Also on Monday, DraftKings announced plans for a new “Super App” merging its sportsbook, iGaming, and Predictions platform; on Friday, the company detailed ESPN account linking for personalized March Madness betting. Meanwhile, a proposed rule change filed with the US Securities and Exchange Commission on Monday revealed the Nasdaq’s intention to introduce outcome-related options on the Nasdaq-100 (INDEXNASDAQ:NDX) and the Nasdaq 100 Micro Index.

- As proposals for AI data centers continue to drive a surging need for power, energy company AES said it is being taken private in a US$33.4 billion deal led by BlackRock's (NYSE:BLK) Global Infrastructure Partners and EQT Partners, marking the second-largest private equity-backed power deal ever recorded.

- Shares of Lumentum Holdings and Coherent jumped on Monday after NVIDIA said it would invest US$2 billion in each company to accelerate the development of advanced optics and laser technologies for AI data centers.

- At this week’s Morgan Stanley (NYSE:MS) tech conference, Nvidia CEO Jensen Huang confirmed that his companys US$30 billion investment in OpenAI is “likely its last major commitment there” and that the original US$100 billion pledged in September 2025 is “not in the cards” due to OpenAI's impending IPO.

- OpenAI has launched GPT-5.4, an AI model targeting the enterprise market. The release includes advanced reasoning capabilities and the ability to autonomously operate computers, alongside new integrations like ChatGPT for Excel and Google Sheets.

- Oracle (NYSE:ORCL) is reportedly planning to eliminate thousands of jobs, possibly as soon as this month, according to people familiar with the situation, who said the cuts would partially target roles that the company anticipates needing less of due to AI.

Tech ETF performance

Tech exchange-traded funds (ETFs) track baskets of major tech stocks, meaning their performance helps investors gauge the overall performance of the niches they cover.

This week, the iShares Semiconductor ETF (NASDAQ:SOXX) declined by 5.91 percent, while the Invesco PHLX Semiconductor ETF (NASDAQ:SOXQ) lost five percent.

The VanEck Semiconductor ETF (NASDAQ:SMH) also decreased by 4.21 percent.

Tech news to watch next week

Investors face a pivotal week ahead, headlined by Monday’s (March 9) release of the NY Fed’s one-year inflation expectations and the highly anticipated February CPI report on Wednesday (March 11), which could provide a key signal for the Fed’s next move.

Later in the week, Thursday’s (March 12) jobless claims will be under the microscope to see if February’s labor trends hold steady. On the corporate side, it’s a big week for software and cloud infrastructure, with Oracle, Hewlett Packard Enterprise, and Constellation Software reporting Monday, followed by Adobe (NASDAQ:ADBE) on Thursday.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

-explained_1.jpg)