Investing News Network

- High grade drill results extend gold mineralisation at Mt Wandoo (2025-12-15)

Green & Gold Minerals Limited (ASX:GG1) is pleased to announce final gold results from the recent Wandoo drill program at the Chillagoe Gold Project. The Mt Wandoo and Little Wandoo prospects are located within granted mining leases with mineralisation commencing at surface. The Company is currently evaluating local milling options, including the Mungana processing facility located approximately 12 km from the project.

- High-grade drill results are reported today from Mt Wandoo, extending and bolstering mineralisation including:

- 6m at 11.1 g/t Au from 38m including 1m at 44.8 g/t Au from 42m (WBR076)

- 12m at 5.9 g/t Au from 59m including 2m at 32.5 g/t Au from 59m and 7m at 1.3 g/t Au from 112m (WBR077)

- 19m at 2.9 g/t Au from 36m including 2m at 24.4 g/t Au from 36m and 8m at 1.4 g/t Au from 99m including 1m at 7.6 g/t Au from 105m (WBR085)

- 18m at 1.9 g/t Au from 109m including 8m @ 3.8 g/t Au from 116m and 8m at 1.1 g/t Au from 155m (WBR084)

- 5m at 1.6 g/t Au from 12m (WDR017)

- Silver results are pending

- WBR084 and WBR085 extended mineralisation south of existing mineral resource estimate (MRE). These high-grade intercepts are open down plunge.

- WBR076 bolsters the western trend, returning a very strong result (6m at 11.1 g/t Au) where no gold mineralisation is recognised in the existing MRE.

- WBR077 extends a high-grade shoot near the centre of the Mt Wandoo MRE with potential to add high grade ounces inside the resource model footprint. The WBR077 intercept (12m at 5.9 g/t Au from 59m) was 28m from the historic intercept of 4m at 12.7 g/t Au, 5 g/t Ag from 88m) in MWRC-02.

- WBR042 has discovered a new zone of mineralisation, with several narrow gold bearing veins over 41m downhole below and outside the eastern extent of the MRE including:

- 2m at 1.4 g/t Au from 104m

- 0.8m at 3.9 g/t Au from 111.5m

- 3.4m at 1.1 g/t Au from 133.8m

- 3m at 2.5 g/t Au from 142m

- WDR017 extends the main mineralisation trend along strike to the NW of the MRE.

Mt Wandoo hosts an existing Inferred JORC Mineral Resource estimate1 of 32,400oz Au and 387,000oz Ag. GG1 is seeking to rapidly expand the resource and to conduct mining studies.

Gold results are reported today for 16 RC holes and 5 diamond tails representing 2280 RC metres and 352 diamond metres.

Drilling was aimed at adding ounces to the existing Mt Wandoo resource estimate within the granted mining leases at the Chillagoe Gold Project as the first step towards mining studies.

A resource update and toll treatment discussions with the idle, modern 600kt gravity/flotation mill at Mungana are planned this quarter and next. The Mungana mill has previously tested Wandoo ore, achieving high recoveries of gold.

Managing Director Quentin Hill commented:

“The high-grade results announced today bolster the company’s strategy to accelerate development of Mt Wandoo to exploit high gold and silver prices and granted mining leases. The results show Mt Wandoo is a significant high-grade system that is set to grow as the new intercepts are integrated into the model.

We look forward to updating the model with the new results, commencing mining study work, toll treatment discussions with the nearby Mungana Mill, and planning more drilling to target more high grades and further define the extensions discovered”.

The Wandoo goldfield has long been recognised for its exceptionally high-grade ore, with historic production from the Hardman mine averaging 39 g/t Au in fresh rock. Recent drilling has delivered multiple bonanza-grade intercepts within broader mineralised zones at shallow depths, confirmin g that the Mt Wandoo system hosts the same high-tenor mineralisation beyond the historic mine workings.

Click here for the full ASX Release

This article includes content from Green & Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

- High-grade drill results are reported today from Mt Wandoo, extending and bolstering mineralisation including:

- Drilling Progresses at the Wagyu Gold Project, Pilbara WA (2025-12-15)

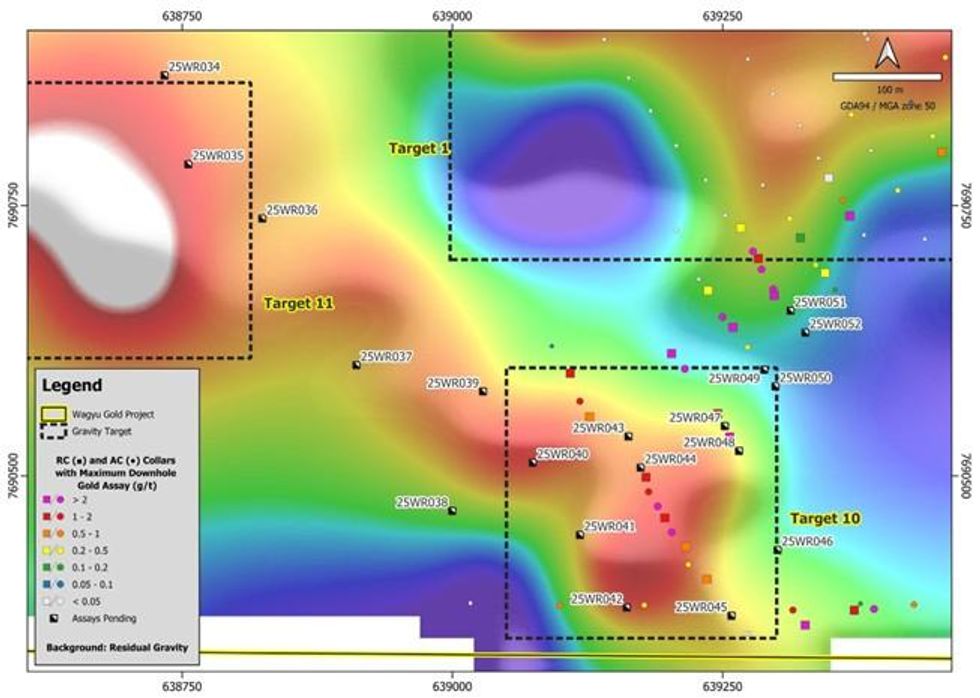

New Age Exploration (ASX: NAE) (NAE or the Company) is pleased to report that the Reverse Circulation (RC) Drill Program is progressing positively at the Wagyu Gold Project (Figure 1). A total of 1,896 m has been drilled so far over 20 drill holes, with an average depth of 95m. The program is targeting strike and depth extensions to known ‘Hemi Style’ gold mineralisation and new undrilled areas of high-gold prospectivity (Refer to ASX Announcement 6 November 2025).Drilling to date has intersected similar lithologies and alteration styles to those from mineralisation drilled in the first RC program (March 2025), and testing at depth has highlighted extensions at depth in the ‘Hemi Style’ intrusives. Gold mineralisation at Wagyu is generally only confirmed from assay data, due to the intense alteration and fine-grained nature of sulphides present.

Drilling will continue to 22nd December and resume in early January.

HIGHLIGHTS

- Drilling is progressing positively at the Wagyu Gold Project with 20 drill holes completed for a total of 1,896m.

- Program has so far tested high-priority Targets 1, 10 and 11. Drill rig has moved north and is currently at Target 6.

- Drilling to date has intersected similar lithologies and alteration styles to those from mineralisation drilled in the first RC program (March 2025), with several intersections at depth in intermediate ‘Hemi Style’ intrusives.

- Assay results are expected throughout Q1 2026.

- The Wagyu Gold Project lies 5km west of Northern Star Resources’ 11.2Moz1 Hemi Gold Deposit within the mineralised Mallina Basin corridor

NAE Executive Director Joshua Wellisch commented:

“We are very pleased with the current progress of the Wagyu drilling program as the team endeavours to advance the extensions of the known gold mineralisation at depth and along strike; uncover new gold mineralisation and to further understand the geological controls.”

Figure 1: Drill hole collars at the Wagyu Gold Project with assays pending for the current RC drill program and the maximum downhole gold assay result shown from previous drilling.

Figure 1: Drill hole collars at the Wagyu Gold Project with assays pending for the current RC drill program and the maximum downhole gold assay result shown from previous drilling.Geology

Encouraging signs of mineralisation have been identified in numerous drill holes during the drill campaign, which NAE hopes will extend the high-grade gold along strike and at depth. Drill hole 25WR045 intercepted 13m of consistent quartz veining within an intrusive body (Figure 1), with associated sulphides (pyrite and pyrrhotite) and alteration (carbonate and chlorite), which is indicative of targeting success.

Figure 2: Chip tray photo of 140-160m in drill hole 25WR045. Note the consistent quartz veining from 142-155m with a significant vein at 151-155m.

Figure 2: Chip tray photo of 140-160m in drill hole 25WR045. Note the consistent quartz veining from 142-155m with a significant vein at 151-155m.Click here for the full ASX Release

This article includes content from New Age Exploration Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

- Drilling is progressing positively at the Wagyu Gold Project with 20 drill holes completed for a total of 1,896m.

- Top 5 Canadian Mining Stocks This Week: Sirios Resources Gains 120 Percent (2025-12-12)

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.

The Bank of Canada Governing Council met on Wednesday (December 10) for the final rate-setting meeting of 2025 and decided to hold its benchmark rate at 2.25 percent. Analysts had widely expected the central bank to maintain the rate and anticipate it remaining unchanged through the start of 2026.

The decision came after Statistics Canada’s jobs report, released December 5, showed that Canada’s labor force remained resilient through November, with 54,000 new jobs and the unemployment rate dropping 0.4 percentage points to 6.5 percent.

Additionally, the BoC noted that Canada’s gross domestic product (GDP) grew 2.6 percent during the third quarter despite domestic demand remaining flat. Looking ahead, it expects fourth-quarter GDP to be weak as exports decline, but anticipates growth to pick up in 2026.

The council suggested that the 2.25 percent rate was the right level to keep inflation near 2 percent while providing enough support for the economy amid uncertainty from US trade policy.

South of the Border, the US Federal Reserve also held its final rate-setting meeting of the year on Tuesday (December 9) and Wednesday. It chose to go in a different direction, lowering its benchmark rate by 25 basis points to the 3.5 to 3.75 percent range.

However, in his statements, Fed Chairman Jerome Powell hinted that the committee may pause some future rate cuts as it takes time to parse data and analyze the effects of the three rate cuts on the US economy.

Powell also stated that there was concern that the Bureau of Labor Statistics may be significantly overestimating the number of jobs created within the US economy by about 60,000 jobs per month, meaning it could actually be losing an average of 20,000 per month.

Due to the government shutdown, the BLS didn’t release September’s jobs report until November 20, which showed growth of 119,000 employees. The agency also noted that it wouldn’t be releasing October’s numbers and would roll them into November’s report, which was delayed until December 16.

A report from human resources firm ADP showed that private employment in November declined by 32,000 jobs, noting that employers have been cautious amid economic uncertainty and cautious consumers.

For more on what’s moving markets this week, check out our top market news round-up.

Markets and commodities react

Canadian equity markets saw mixed gains this week.

The S&P/TSX Composite Index (INDEXTSI:OSPTX) was little changed, gaining just 0.1 percent over the week to close Friday at 31,527.39 and the S&P/TSX Venture Composite Index (INDEXTSI:JX) was also flat rising 0.17 percent to 954.61.

On the other hand, the CSE Composite Index (CSE:CSECOMP) spiked 15.63 percent to close at 180.36 alongside a surge in cannabis stocks on Friday after it was reported that the White House was planning to reschedule cannabis this coming Monday (December 15).

The gold price reacted positively to the Fed’s rate cut gaining 2.44 percent on the week with the biggest gains coming at the end of the week, to reach US$4,299.86 per ounce on Friday at 4 p.m. EST.

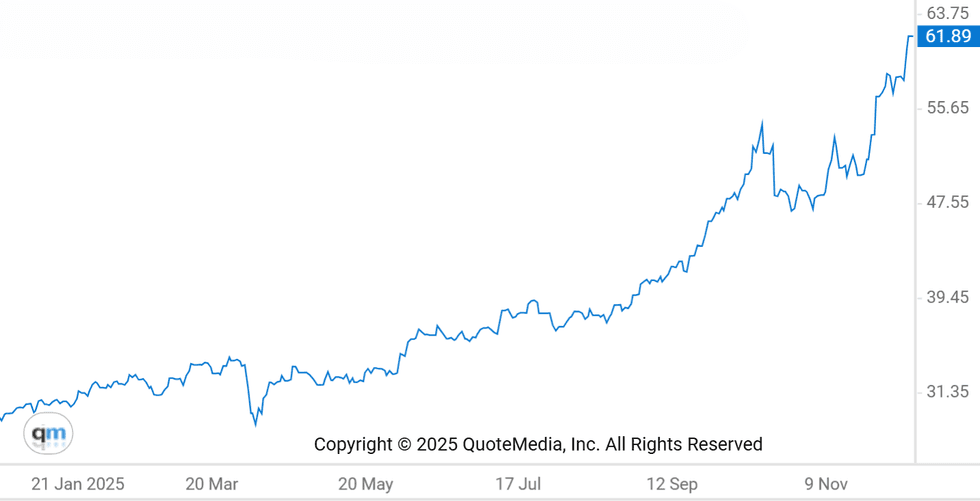

Meanwhile, the silver price continued soaring with a substantial weekly gain of 6.12 percent, setting a new all time high of US$64.65 per ounce in morning trading on Friday before slipping to end the day at US$61.95.

In base metals, the COMEX copper price ended the week down 1.46 percent at US$5.37 per pound.

The S&P Goldman Sachs Commodities Index (INDEXSP:SPGSCI) fell 2.63 percent to end Friday at 545.47.

Top Canadian mining stocks this week

How did mining stocks perform against this backdrop?

Take a look at this week’s five best-performing Canadian mining stocks below.

Stocks data for this article was retrieved at 4:00 p.m. EST on Friday using TradingView's stock screener. Only companies trading on the TSX, TSXV and CSE with market caps greater than C$10 million are included. Mineral companies within the non-energy minerals, energy minerals, process industry and producer manufacturing sectors were considered.

1. Sirios Resources (TSXV:SOI)

Weekly gain: 120 percent

Market cap: C$48.26 million

Share price: C$0.165Sirios Resources is a gold exploration company advancing a portfolio of projects in the Eeyou Istchee James Bay region of Québec, Canada.

The company’s Aquilon property covers 7,100 hectares and hosts over 30 gold showings. It’s the subject of a December 2022 earn-in agreement that could see Sumitomo Metal and Mining earn up to an 80 percent interest through exploration commitments and cash payments totaling C$14.8 million.

On December 4, Sirios released assay results from a 13 hole, 5,420 meter drill program carried out at Aquilon during the summer targeting an underexplored area west of historic showings. Highlights from the program included one hole with 2.55 grams per metric ton (g/t) of gold over 4.8 meters, which included an interval of 10.3 g/t over 1 meter.

Sumitomo funded the program and pushes its exploration investments beyond the C$4.8 million commitment needed to earn a 51 percent stake in the project.

Sirios also owns the 15,700 hectare Cheechoo project, which hosts the namesake deposit. A mineral resource estimate included in an August 2025 technical report demonstrated a total indicated resource of 1.26 million ounces of gold with an average grade of 1.12 g/t from 34.99 metric tons of ore, with an additional inferred resource of 1.67 million ounces with an average grade of 1.23 g/t from 42.72 million metric tons.

On Thursday (December 11), Sirios announced it entered into an arrangement to acquire private company OVI Mining, which was recently spun-out of Electric Elements Mining, a subsidiary of Osisko Development (TSXV:ODV) and O3 Mining.

The two will merge to create a Québec-focused gold company with a district-scale land package centred on the Cheechoo deposit and supported by OVI’s Corvet Est and PLEX projects.

Jean-Felix Lepage, former Vice President of Project Development at O3 Mining, will become the CEO of the combined company. The deal is also backed by Osisko, whose CEO Sean Roosen and Vice President of Strategic Development Laurence Farmer will join the board upon the closing of the deal.

Sirios Founder and CEO Dominique Doucet said, “By integrating their experience as industry leaders in corporate finance and mine development with our deep knowledge of geology and exploration, we will work diligently towards advancing our flagship Cheechoo deposit into gold production.”

2. Eco (Atlantic) Oil & Gas (TSXV:EOG,OTC Pink:ECAOF)

Weekly gain: 78.38 percent

Market cap: C$99.3 million

Share price: C$0.33Eco Atlantic is an oil and gas exploration company focused on a portfolio of offshore assets in the Atlantic Ocean.

Its holdings include a 100 percent interest in the Orinduik block and a 1.3 percent interest in ExxonMobil’s Canje Block off the coast of Guyana; an 85 percent working interest in PEL 97, 99 and 100 in the Wavis basin off the coast of Namibia; and, off the coast of South Africa, a 75 percent working interest in Block 1 and a 5.25 percent interest in Block 3B/4B.

The most recent news from Eco came on December 4, when it entered into a farm-in agreement with Navitas Petroleum.

Under the terms of the deal, Navita will pay US$2 million up front for the exclusive options to earn an 80 percent interest in the Orinduik block for an additional US$2.5 million payment, and a 47.5 percent interest in Block 1 in South Africa for an additional US$4 million. If Navita exercises the agreements, it will become the operator of the assets as well.

3. Karnalyte Resources (TSX:KRN)

Weekly gain: 65.63 percent

Market cap: C$11.72 million

Share price: C$0.265Karnalyte Resources is an exploration and development company advancing its Wynyard potash project in Central Saskatchewan, Canada.

The property consists of three primary mineral leases covering 367 square kilometers east of Saskatoon.

Shares in Karnalyte have been climbing since it released an updated feasibility study for the project on November 26. The study demonstrated economic viability, according to Karnalyte, with an after-tax net present value of C$2.04 billion, an internal rate of return of 12.5 percent, a payback period of 8.8 years, and a mine life of 70 years.

The company also stated that development would benefit from a secured offtake agreement under which India-based GFSC would purchase 350,000 metric tons per year during Phase 1, with additional commitments for 250,000 metric tons per year after Phase 2 is complete.

4. PJX Resources (TSXV:PJX)

Weekly gain: 82.35 percent

Market cap: C$26.17 million

Share price: C$0.155PJX Resources is an exploration company focused on gold, silver and base metal properties in British Columbia, Canada.

The company has largely been exploring claims around Cranbrook, in the southeast portion of the province. PJX has been focused on the Cranbrook area due to the co-existence of a significant base metals deposit with untapped gold potential.

The region is home to the historic Sullivan mine, which produced most of the region’s production of over 285 million ounces of silver, 8.5 million metric tons of lead and 8 million metric tons of zinc.

Additionally, the company states that the region may be responsible for more than 1.5 million ounces of historic placer gold production, but significant gold deposits have not yet been discovered.

In total, the company has amassed a land claim of over 50,000 hectares in the region, centered around these historic claim sites.

On Thursday, PJX announced that it had discovered a large sedimentary exhalative mineralized system at its Dewdney Trail property. The company said that recent drilling intersected 63 meters of anomalous mineralization in the Quake zone, including zinc, lead, silver and other critical metals, and that it bears similarities to bands of mineralization from the Sullivan mine.

Additionally, the company said that exploration discovered boulders 800 meters south along strike from the drilling area with assays of 546 g/t silver, 32.3 percent lead, and 4.89 percent zinc.

5. Triumph Gold (TSXV:TIG)

Weekly gain: 64.56 percent

Market cap: C$30.63 million

Share price: C$0.65Triumph Gold is an explorer and developer advancing projects in the Yukon and BC, Canada, and Utah, United States.

Its three properties in the Yukon are all within the Dawson Range and consist of its flagship Freegold Mountain project, which has 20 identified mineral resources hosting gold, silver, copper, molybdenum, lead and zinc deposits; the Tad/Toro copper, gold and molybdenum project; and the Big Creek copper and gold project.

Triumph's property in Northern BC is called Andalusite Peak, and on June 4, the company announced the acquisition of the Coyote Knoll silver-gold property in Utah.

On May 9, the company announced it had refined its exploration focus on geochemical surveys and detailed geological mapping at the Andalusite Peak project, and defined new targets at Freegold Mountain.

Triumph's most recent update came on November 27, when it closed a non-brokered private placement for gross proceeds of C$1.94 million.

FAQs for Canadian mining stocks

What is the difference between the TSX and TSXV?

The TSX, or Toronto Stock Exchange, is used by senior companies with larger market caps, and the TSXV, or TSX Venture Exchange, is used by smaller-cap companies. Companies listed on the TSXV can graduate to the senior exchange.

How many mining companies are listed on the TSX and TSXV?

As of May 2025, there were 1,565 companies listed on the TSXV, 910 of which were mining companies. Comparatively, the TSX was home to 1,899 companies, with 181 of those being mining companies.

Together, the TSX and TSXV host around 40 percent of the world’s public mining companies.

How much does it cost to list on the TSXV?

There are a variety of different fees that companies must pay to list on the TSXV, and according to the exchange, they can vary based on the transaction’s nature and complexity. The listing fee alone will most likely cost between C$10,000 to C$70,000. Accounting and auditing fees could rack up between C$25,000 and C$100,000, while legal fees are expected to be over C$75,000 and an underwriters’ commission may hit up to 12 percent.

The exchange lists a handful of other fees and expenses companies can expect, including but not limited to security commission and transfer agency fees, investor relations costs and director and officer liability insurance.

These are all just for the initial listing, of course. There are ongoing expenses once companies are trading, such as sustaining fees and additional listing fees, plus the costs associated with filing regular reports.

How do you trade on the TSXV?

Investors can trade on the TSXV the way they would trade stocks on any exchange. This means they can use a stock broker or an individual investment account to buy and sell shares of TSXV-listed companies during the exchange's trading hours.

Article by Dean Belder; FAQs by Lauren Kelly.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Lauren Kelly, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: JZR Gold is a client of the Investing News Network. This article is not paid-for content.

- Editor's Picks: Silver Price Sets New Record as Fed Cuts Rates, Gold Retakes US$4,300 (2025-12-12)

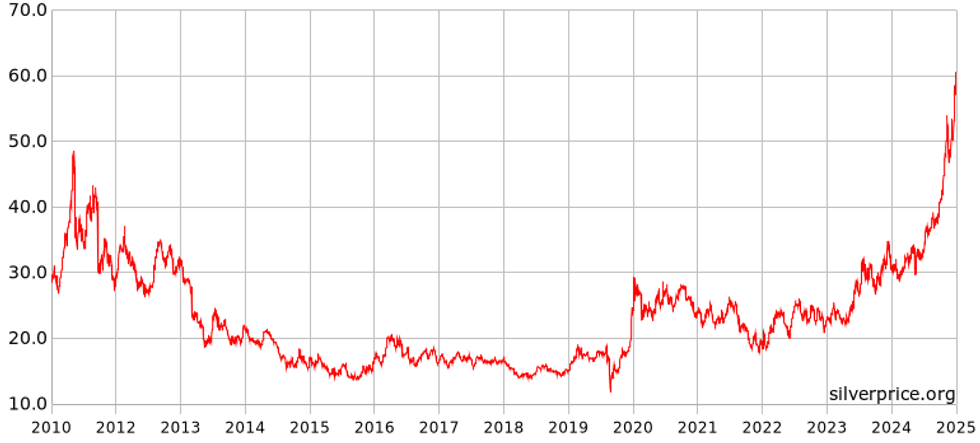

2025 is drawing to a close, and silver seems determined to end the year with a bang.

The white metal's breakout continued this week, with the price crashing through US$60 per ounce and continuing on up, even briefly passing US$64. It ultimately finished at just under US$62.

Year-to-date silver is now up over 110 percent, far outpacing gold's gain of about 63 percent.

Its latest rise kicked off on November 28, the same day the Comex experienced an outage that lasted about 10 hours. Since then, positive drivers have continued to pile up.

Chief among them this week was the most recent interest rate reduction from the US Federal Reserve. As was widely expected, the central bank made a 25 basis point cut at its meeting, which wrapped up on Wednesday (December 10), taking the target range to 3.5 to 3.75 percent.

Both silver and gold tend to fare better in lower-rate environments, and while gold remains below its all-time high, it retook the US$4,300 per ounce level this week.

Key Fed meeting takeaways

It's worth noting that although the Fed's cut went through, three out of 12 officials voted against it, a situation that hasn't happened since September 2019. Two wanted rates to stay the same, while Governor Stephen Miran was calling for a 50 basis point reduction.

Miran took his spot on the Fed's Board of Governors in September after being nominated by President Donald Trump, who has been critical of the Fed — and Chair Jerome Powell in particular — for not lowering rates as quickly as he would like. Powell's term ends in May 2026, and it’s anticipated that his replacement will follow Trump’s vision. Kevin Hassett of the National Economic Council is said to be a strong contender, with 84 percent of respondents to a CNBC survey saying they think it will be him.

While the Fed's rate decision was in focus this week, market watchers are also closely eyeing its post-meeting statement, as well as press conference comments from Powell, to figure out what the central bank's policy will look like heading into the new year and beyond.

The latest dot plot shows that Fed officials expect only one rate cut in 2026, plus another in 2027. That's unchanged from projections made in September, but experts have pointed out that the dot plot also highlights the growing divide between Federal Open Market Committee members.

Another important facet is the news that the Fed will start buying short-dated bonds as of Friday (December 12), with an initial round involving purchasing US$40 billion worth of treasuries per month. This move comes after the end of quantitative tightening measures on December 1, and is being looked at as a step in the direction of quantitative easing.

"This is basically another way of saying quantitative easing, and we're going to continue to print money," said David Erfle of Junior Miner Junky. "The Federal Reserve is in a situation where, 'Hey, we've got to continue to issue new debt to pay off the old debt.' So now the yield curve is going to steepen as the Fed pivots toward these treasury bills, and private investors are going to have to absorb more duration risk. So basically, this means loose monetary conditions are on the way, and that's positive for both gold and especially now silver."

Will the silver price keep rising?

With that in mind, what exactly is next for the silver price?

I've been asking guests on our channel where the metal goes from here, and many have said it's becoming harder and harder to predict as silver enters uncharted territory.

Peter Krauth of Silver Stock Investor and Silver Advisor said that a "relatively conservative" outlook for 2026 would be US$70. However, he also emphasized that higher levels are possible:

"It's taken 45 years for (silver) to finally break out through that US$50 level. And so we're in uncharted waters, uncharted territory, and this being the kind of market that we're in — fundamentally, as well as macroeconomically, as well as geopolitically — I think odds are silver is going to continue to climb higher.

"And I think it's going to convert a lot of doubters into into believers that silver is going to go on setting new record highs, and that it's still relatively early in this market. We're going to see it perform very, very well for several more years."

For his part, Erfle weighed in on upside and downside for silver, outlining how the precious metal could get close to the US$100 level. Here's what he said:

"If you consider the supply/demand fundamentals, this is a fifth year of a supply deficit in silver, which has constantly been outpacing supply.

"All these forces have converged to take the silver price so much higher, and looking at upside targets, the next target is the US$66, US$68 area, and then US$80 to US$83 if the momentum continues into January. But the long-term measured target of the cup-and-handle breakout is US$96."

I'll be having more conversations about silver next week with experts like Gareth Soloway, John Rubino and John Feneck, so drop a comment on our YouTube channel if you have any questions.

Want more YouTube content? Check out our expert market commentary playlist, which features interviews with key figures in the resource space. If there's someone you'd like to see us interview, please send an email to cmcleod@investingnews.com.

And don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- What Was the Highest Price for Silver? (2025-12-12)

Like its sister metal gold, silver has been attracting renewed attention as a safe-haven asset.

Although silver continues to exhibit its hallmark volatility, a silver bull market is well underway in 2025.

Experts are optimistic about the future, and as the silver price's momentum continues in 2025, investors are looking for price forecasts and asking, “What was the highest price for silver?”

The answer reveals how much potential there is for the silver price to rise.

Read on for a look at silver's historical moves, its new all-time high price and what they could mean for both the price of silver today and the white metal’s price in the future.

In this article

- How is silver traded?

- What is silver's all-time high price?

- Silver price history since 2011

- Silver price performance in 2025

- Is the silver price manipulated?

- Investor takeaway

How is silver traded?

Before discovering what the highest silver price was, it’s worth looking at how the precious metal is traded. Knowing the mechanics can be useful in understanding why and how its price changes on a day-to-day basis and beyond.

Put simply, silver bullion is traded in dollars and cents per ounce, with market activity taking place worldwide at all hours, resulting in a live silver price. Key commodities markets like New York, London and Hong Kong are just a few locations where investors trade the metal. London is seen as the center of physical silver trade, while the COMEX division of the New York Mercantile Exchange, called the NYMEX, is where most paper trading is done.

There are two popular ways to invest in silver. The first is through purchasing silver bullion products such as bullion bars, bullion coins and silver rounds. Physical silver is sold on the spot market, meaning that to invest in silver this way, buyers pay a specific price for the metal — the silver price per ounce — and then have it delivered immediately.

The second is accomplished through paper trading, which is done via the silver futures market, with participants entering into futures contracts for the delivery of silver at an agreed-upon price and time. In such contracts, two positions can be taken: a long position to accept delivery of the metal or a short position to provide delivery.

Paper trading might sound like a strange way to get silver exposure, but it can provide investors with flexibility that they wouldn’t get from buying and selling bullion. The most obvious advantage is perhaps the fact that trading in the paper market means silver investors can benefit long term from holding silver without needing to store it. Furthermore, futures trading can offer more financial leverage in that it requires less capital than trading in the physical market.

Market participants can also invest in silver through exchange-traded funds (ETFs). Investing in a silver ETF is similar to trading a stock on an exchange, and there are several silver ETFs to choose from. Some ETFs focus on physical silver bullion, while others focus on silver futures contracts. Still others focus on silver stocks or follow the live silver price.

What is silver's all-time high price?

The silver all-time high was US$64.65, which it set on December 12, 2025.

The price of silver has rallied in 2025, and first broke its previous all-time high on October 9. It went on to test the US$54 mark multiple times, before finally making a decisive move above it on November 28. That day, the silver price spiked to US$56.53 following a 10 hour shutdown of trading on the CME Group's (NASDAQ:CME) Comex and surrounding speculation on the cause.

Silver continued setting new highs over the following weeks. The latest came on December 12, the day after the US Federal Reserve announced it decided to cut interest rates by 25 basis points at the December meeting. News that the Fed will also start buying short-term treasuries supported silver as well, sparking discussions about the return of quantitative easing.

Before October 9 of this year, the white metal's all-time high had been the same for 45 years — silver's former all-time high was US$49.95, and it was set on January 17, 1980.

It's worth unpacking what happened, because the price didn’t exactly reach that level by honest means.

As Britannica explains, two wealthy traders called the Hunt brothers attempted to corner the market by buying not only physical silver, but also silver futures — they took delivery of those silver futures contracts instead of taking legal tender in the form cash settlements. Their exploits ultimately ended in disaster: On March 27, 1980, they missed a margin call and the silver market price plunged to US$10.80. This day is infamously known as Silver Thursday.

That record silver price wouldn’t be tested again until April 2011, when it reached US$47.94. This was more than triple the 2009 average silver price of US$14.67, with the price uptick coming on the back of very strong investment demand.

So what happens next? While silver has officially broken its 1980 peak, it is still well below that price point adjusted for inflation. It remains to be seen just how high silver can go.

Silver's price history since 2011

After its 2011 peak, silver's price pulled back over the following years before settling between US$15 and US$20 for much of the second half of last decade. An upward trend in the silver price started in mid-2020, when it was spurred on by the economic uncertainty surrounding the COVID-19 pandemic. The price of silver breached the key US$26 level in early August 2020, and soon after tested US$30. However, it failed to make substantial progress past that.

In the spring of 2023, the silver price surged by 30 percent, briefly rising above US$26 in early May; however, the precious metal cratered back down to US$20.90 in early October. Later that month, silver advanced toward the US$23 level on the back of safe-haven demand due to the outbreak of the Israel-Hamas war.

Following remarks from US Federal Reserve Chair Jerome Powell, speculation about interest rate reductions sent the price of silver to US$25.48 on November 30, its highest point for the fourth quarter.

After starting 2024 on a low note, the white metal saw gains in March on rising Fed rate cut expectations. The resulting upward momentum led silver to reach a Q1 high of US$25.62 on March 20 before breaking through the US$30 mark on May 17. The silver price reached a then 12 year high of US$32.33 on May 20.

In Q3, the metal's price slid down below the US$27 mark to as low as US$26.64 by August 7 alongside its industrial cousin copper. Heading into Q4 2024, silver reversed course to the upside, tracking the record breaking moves in the gold price. Silver once again breached the US$30 level on September 13 and continued higher.

On October 21, the silver price moved as high as US$34.20 during the trading day, up more than 48 percent since the start of the year and its highest level in 12 years. However, silver spent the rest of the year in decline, bottoming out at US$28.94 on December 30.

Silver's price performance in 2025

The silver price experienced a momentum shift at the start of 2025, breaking through the US$30 barrier as early as January 5, and reaching US$31.31 by January 29. The metal continued to post gains through much of February and March, climbing to US$32.94 on February 20 and then peaking at its quarterly high of US$34.21 on March 28.

Following US President Donald Trump's tariff announcements on April 2, silver slumped to below US$30. While the Trump administration’s tariff policies have been largely beneficial for safe-haven assets like precious metals, there were concerns that the threat of tariffs could weaken industrial demand, which could cool price gains in the silver market.

Yet those concerns were pushed to the back burner as recent economic and geopolitical events have raised analysts’ expectations of a September rate cut by the Fed. The benchmark rate has not changed since November 2024.

On June 5, the silver price rose to a 13 year high of US$36.05 in early morning trading, before retreating toward the US$35.50 mark. By June 16, the white metal had broken through the US$37 mark for the first time since May 2011.

In July, increasing geopolitical strife in the Middle East and Russia-Ukraine coupled with a positive outlook for China’s solar power industry proved price positive for both silver’s precious metals and industrial angles.

The silver price overtook the US$39 level to reach US$39.24 on July 22.

These same forces, coupled with the nearly unanimous rate cut expectations, launched the price of silver to over US$40 on August 31 for the first time since 2011, and by September 3 it had climbed as high as US$41.45. Silver continued climbing through September, progressively breaking level after level to top US$47 by the month's end.

The white metal broke its all-time highs in most currencies, including Canadian dollars and Australian dollars, on September 22.

Silver started Q4 by continuing its ascent, breaking through its 2011 peak and topping US$48 on October 3, before climbing above US$51 to beat its US dollar high on October 9.

It continued climbing even higher on the safe-haven demand fundamentals behind its 2025 momentum. Helping drive that demand in October was escalating trade tensions between the US and China, leading to export controls on additional rare earth metals by China and threats of 100 percent tariffs on Chinese imports by the US.

While silver pulled back to around US$48 in late October, news that the US government shut down had come to an end on November 9 drove the silver price back above US$50.

Silver's foray above the US$56 level on November 28 came on the back of an outage at the Comex, where trading was briefly halted due to a "cooling issue" at a CyrusOne data center used by the exchange.

Silver continued even higher through early December, and on December 12 the metal set a new highest price of US$64.65 two days after the Fed decided to once again cut interest rates.

Silver supply and demand dynamics

Market watchers are curious as to whether the silver price will continue its upward trajectory in 2025. Only time will tell, and it will depend on the white metal's ability to remain above the critical US$30 level.

Like other metals, the silver spot price is most heavily influenced by supply and demand dynamics. However, as the information above illustrates, the silver price can be highly volatile. That's partially due to the fact that the metal is subject to both investment and industrial metal demand within global markets.

In other words, it’s bought by investors who want it as a store of wealth, as well as by manufacturers looking to use it for different applications that are incredibly varied. For example, silver has diverse technological applications and is used in devices like batteries and catalysts, but it’s also used in medicine and in the automotive industry.

In terms of supply, the world’s three top producers of the metal are Mexico, China and Peru. Even in those countries silver is usually a by-product — for instance, a mine producing primarily gold or lead might also have silver output.

The Silver Institute's latest World Silver Survey, put together by Metals Focus, outlines a 0.9 percent increase in global mine production to 819.7 million ounces in 2024. This was in partly the result of a return to operations at Newmont's (TSX:NGT,NYSE:NEM,ASX:NEM) Peñasquito mine in Mexico following a suspension of activity brought about by strike action among workers and improved recoveries out of Fresnillo (LSE:FRES,OTC Pink:FNLPF) and MAG Silver's (TSX:MAG,NYSEAMERICAN:MAG) Juanicipio. Silver output also increased in Australia, Bolivia and the US.

The firm is forecasting a 1.9 percent rise in global silver mine production to 823 million ounces in 2025. Much of that growth is expected to come out of Mexico, and it is also projecting output will rise in Chile and Russia.

Lower production from Australia and Peru will offset some of these gains.

Looking at demand, Metals Focus sees growth in 2025 flatlining as industrial fabrication takes a hit from the global tariff war. This could be tempered by an anticipated rebound in demand from physical investment in silver bars and coins.

The silver market is expected to experience a substantial deficit of 117.6 million ounces in 2025, amounting to the sixth straight year of supply shortage for the metal.

Is the silver price manipulated?

As a final note on silver, it’s important for investors to be aware that manipulation of prices is a major issue in the space.

For instance, in 2015, 10 banks were hit in a US probe on precious metals manipulation. Evidence provided by Deutsche Bank (NYSE:DB) showed “smoking gun” proof that UBS Group (NYSE:UBS), HSBC Holdings (NYSE:HSBC), the The Bank of Nova Scotia (TSX:BNS) and other firms were involved in rigging silver rates from 2007 to 2013. In May 2023, a silver manipulation lawsuit filed in 2014 against HSBC and the Bank of Nova Scotia was dismissed by a US court.

JPMorgan Chase & Co. (NYSE:JPM) has been long at the center of silver manipulation claims as well. For years the firm has been in and out of court for the accusations. In 2020, JPMorgan agreed to pay US$920 million to resolve federal agency probes regarding the manipulation of multiple markets, including precious metals.

In 2014, the London Silver Market Fixing stopped administering the London silver fix, which had been used for over a century to fix the price of silver. It was replaced by the LBMA Silver Price, which is run by ICE Benchmark Administration, in a bid to increase market transparency.

Market watchers like Ed Steer have said that the days of silver manipulation are numbered, and that the market will see a significant shift when the time finally comes.

Investor takeaway

Silver has neared US$50 multiple times, including its all-time high, and as momentum continues for the silver price in 2025 investors are wondering if it could reach those heights once again.

While it's impossible to know for sure what's next for silver, keeping an eye on the factors driving its performance, including gold's performance, geopolitics, the economy and industrial demand, will help investors make decisions on when to buy and sell.

Additionally, keeping up-to-date on what precious metals experts are predicting for gold and silver in INN's expert interviews can help investors stay on top of the market.

This is an updated version of an article first published by the Investing News Network in 2015.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Pistilli, currently hold no direct investment interest in any company mentioned in this article.

-explained_1.jpg)